UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C.DC 20549

SCHEDULE 14A

Proxy Statement Pursuant to SectionPROXY STATEMENT PURSUANT TO SECTION 14(a) of the SecuritiesExchange Act of

OF THE SECURITIES EXCHANGE ACT OF 1934

(Amendment No. )

| Filed by the Registrant |   | Filed by a Party other than the Registrant |

| Check the appropriate box: | |

| Preliminary Proxy Statement |

| Confidential, for Use of the Commission Only (as permitted by Rule |

| Definitive Proxy Statement |

| Definitive Additional Materials |

| Soliciting Material |

Polaris Inc.

(Name of Registrant as Specified Inin Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| Payment of Filing Fee (Check | ||

| No fee required. | |

| Fee paid previously with preliminary materials. | |

| Fee computed on table | |

PRELIMINARY COPY - SUBJECT TO COMPLETION

In accordance with Rule 14a-6(d) under Regulation 14A of the Securities Exchange Act of 1934,

as amended, please be advised that Polaris Inc. intends to release definitive copies of this proxy statement

to shareholders beginning on or about March 15, 2023.

|  | |

| John Wiehoff Chair of |  | Michael T. Speetzen Chief Executive Officer | |

| ||||

| On behalf of the | |||

|  |

| Chair of the Board and to collaborate with our accomplished and engaged board members. 2022 was a season of re-invigoration and resilience. Despite economic challenges, the team delivered record sales and earnings and Polaris continued to be the global leader in powersports, a testament to the focus and dedication of our team members. When we visit the Company’s research and development facility in Wyoming, Minnesota, there is nothing like seeing innovation in action to remind us of where we started and how far we have come.

We spoke with many of you this year during our robust shareholder engagement season. As a result of your feedback, you will find several enhancements throughout the proxy, including a new matrix linking the Company’s six strategic pillars to our Board’s skills, as well as a more detailed table identifying the skills attributable to each director. We also took to heart your feedback on our sustainability programs and will be rolling out new, more rigorous environmental goals in our Geared for Good Corporate Sustainability Report this spring. We thank you for your continued commitment and investment in Polaris and hope you give us your voting support on the items described in this proxy statement. Your vote and feedback are important to us. On behalf of the entire Board, thank you for your confidence and investment in Polaris. Sincerely,

| On behalf of our entire team, I want to thank you for your continued support for Polaris. The best team in powersports delivered record sales and earnings per share last year, and I’m incredibly proud of the team’s ongoing commitment to our customers, dealers and shareholders as we continue to raise the bar and pursue our relentless focus on powersports. We doubled down on that commitment last year and made strong progress on our five-year strategy and long-term financial targets. Under our renewed strategy, we refocused on and reinvested in the core of our powersports businesses: Off Road, On Road and Marine, along with the complementing PG&A and Powersports Aftermarket brands that support these segments. No one knows the industry better than this team, and we are uniquely positioned to build on our current leadership position in powersports. With new consumers continuing to discover the experiences afforded by our industry, Polaris is well positioned to capitalize on this growing interest in the outdoors. Our clear sense of purpose and six strategic pillars remain unwavering. From delivering safe and high-quality vehicles to customers, to launching innovative new products and services that elevate our industry, to enhancing how new and current consumers engage with us, to deploying capital that expands our operations and drives efficiencies, our actions and decisions are setting Polaris up for a strong 2023 and will accelerate our growth and financial performance over the long-term. In keeping with our commitment to being good stewards, we are introducing new environmental goals and other initiatives in our Geared for Good Corporate Responsibility Report this May. These efforts reflect our deep connection to the outdoors, in addition to driving long-term shareholder value for Polaris through more productive operations, an engaged workforce, and deeper relationships with the communities where we live and work. The actions we take today are accelerating our goals for tomorrow. I’m energized for the year ahead and excited to continue inspiring adventure and helping even more people THINK OUTSIDE. Sincerely, | ||

| ||||

Dear Fellow Shareholders:

Watching the Polaris team navigate 2020 made me proud to be a Polaris shareholder and to serve my fellow shareholders as your Board Chair. From the onset of the COVID-19 pandemic, your Board, senior leadership, and the entire Polaris team responded to the unforeseen challenges with agility and focus that delivered a record year, positioned our Company for long-term sustainable growth, and enabled our customers to be safely outdoors and active in a very difficult year.

Our senior leadership team made astute, critical decisions while staying committed to our core values and balancing key stakeholder interests. We invested to keep employees safe. We supported dealers and suppliers with critical financial backing. We leveraged THINK OUTSIDE to build loyalty with current riders, draw in new customers and drive growth in the Powersports market. We made difficult but necessary cost reduction decisions across the organization. And, finally, we quickly reinforced our balance sheet in the midst of significant market turbulence and operational uncertainty, allowing Polaris to continue investing in innovation while maintaining our dividend to shareholders. The Polaris team’s deft management of this crisis allowed us to begin 2021 with strong momentum.

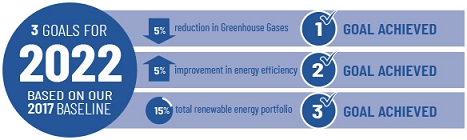

We are committed to corporate social responsibility under our Geared for Good framework. We achieved two of our three environmental goals ahead of schedule – a 5% reduction in greenhouse gas and a 5% improvement in energy efficiency -- and we remain committed to achieving a 15% total renewable energy portfolio by 2022. Please look for our Sustainability Report which will be published this Spring for more information about this and other ESG initiatives, including our initial reporting against the Sustainability Accounting Standards Board framework. Our proxy statement also contains details of key changes the Board adopted in 2020 to our Corporate Governance Guidelines, which continue to align our corporate governance with best practices.

I am privileged to lead a Board with deep expertise and talent, which includes four new directors elected in the past five years. In 2021, we will continue to assess the composition of our Board to be sure that we have the right diversity of thought, experience, attributes and background in our boardroom to advance the Company’s long-term strategy. After 18-years of service on the Board, Annette Clayton is retiring from the Board. Annette has been a thoughtful, highly strategic, and resolute board member who was instrumental in guiding Polaris over the years. On behalf of the Board, we thank her for her dedicated service.

In 2020 we also began a CEO transition—the first in over 12 years. The Board views the selection of our next CEO as one of the most important decisions that shareholders put in our hands. Until a decision is made, the Board has full confidence that we can continue executing against our long-term strategy under Interim CEO, Mike Speetzen, and his strong senior leadership team.

We are sincerely grateful for your continued investment in Polaris and hope you will give us your voting support on the items described in the proxy statement. Your vote and your feedback are important to us. On behalf of our Board of Directors, thank you again for your confidence, support and investment in Polaris.

Sincerely,

|  |

|

|

Dear Fellow Shareholders:

2020 was a strong reminder of how important it is for families and friends to be outdoors, active, and safely engaged with one another. We were pleased that we could play a small part in making that possible for so many, while keeping our employees safe and delivering a record year for our shareholders.

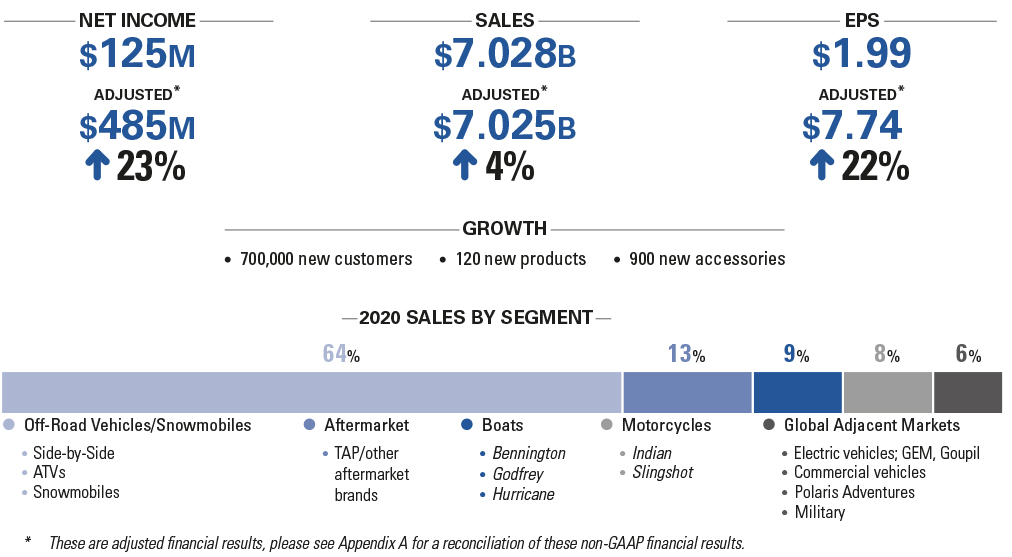

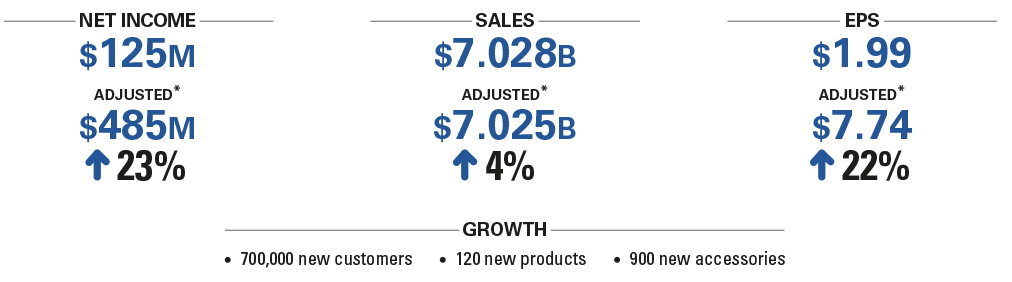

I was humbled to watch the Best Team in Powersports—nearly 15,000 strong—adjust to a very dynamic year. We successfully shifted from managing temporary plant shutdowns and implementing COVID-19 protocols for our employees to managing significant supply chain disruptions as we experienced a surge in demand for our products. By being laser focused on execution, we were able to end the year with adjusted sales and earnings growth of 4 percent and 22 percent, respectively, and surpassing $7 billion in sales for the first time in our Company’s history.

Our THINK OUTSIDE messaging is resonating well with customers. In 2020 we welcomed approximately 700,000 new customers and Powersports enthusiasts into the Polaris family. Despite the unprecedented circumstances, our investments in innovation – the life blood of Polaris – remained strong. We launched more than 120 new products across our vehicle portfolio during the year, along with 900+ new accessories in our PG&A business and Aftermarket segments. We made progress on our digital initiatives with the launch of RideReady and Polaris Adventures Select, as well as announced our goal to lead the powersports industry in electrification.

Underpinning our performance in 2020 was our commitment to safety and ethics—a Polaris Guiding Principle. In 2020, we continued to improve employee safety at our operations and rolled out a new Code of Conduct that outlines our expectations. While we hit some highlights in this proxy statement, I invite you to learn more about our Geared for Good initiatives and progress in our Corporate Responsibility Report that we expect to issue in the Spring.

In 2021, we will be focused on our key strategic objectives: growing market share, innovating, continuing to improve quality, transforming our supply chain, and executing on our electrification and digital strategies. I am optimistic for our future—Polaris is spring-loaded and ready to capitalize on the great opportunity ahead. Thank you for joining us on this ride.

Sincerely,

PolarisInc.

2100 Highway 55

2100 Highway 55

Medina, Minnesota 55340

Notice of

Annual Meeting

of Shareholders

Thursday, April 29, 202127, 2023

9:00 a.m. Central Time

Polaris Inc. (Polaris or the Company) will hold its 20212023 Annual Meeting of Shareholders (the Annual Meeting) on Thursday, April 29, 202127, 2023 at 9:00 a.m. Central Time. The Annual Meeting will be completely virtual. You may attend the meeting, submit questions, and vote your shares electronically during the meeting via live webcast by visiting www.virtualshareholdermeeting.com/PII2021PII2023. You will need the 16-digit control number that is printed in the box marked by the arrow on your Notice of Internet Availability of Proxy Materials or proxy card to enter the Annual Meeting. We recommend that you log in at least 15 minutes before the meeting to ensure you are logged in when the meeting starts. The proxy materials were either made available to you over the Internet or mailed to you beginning on or about March 16, 2021.15, 2023. At the meeting, our shareholders will be asked to:

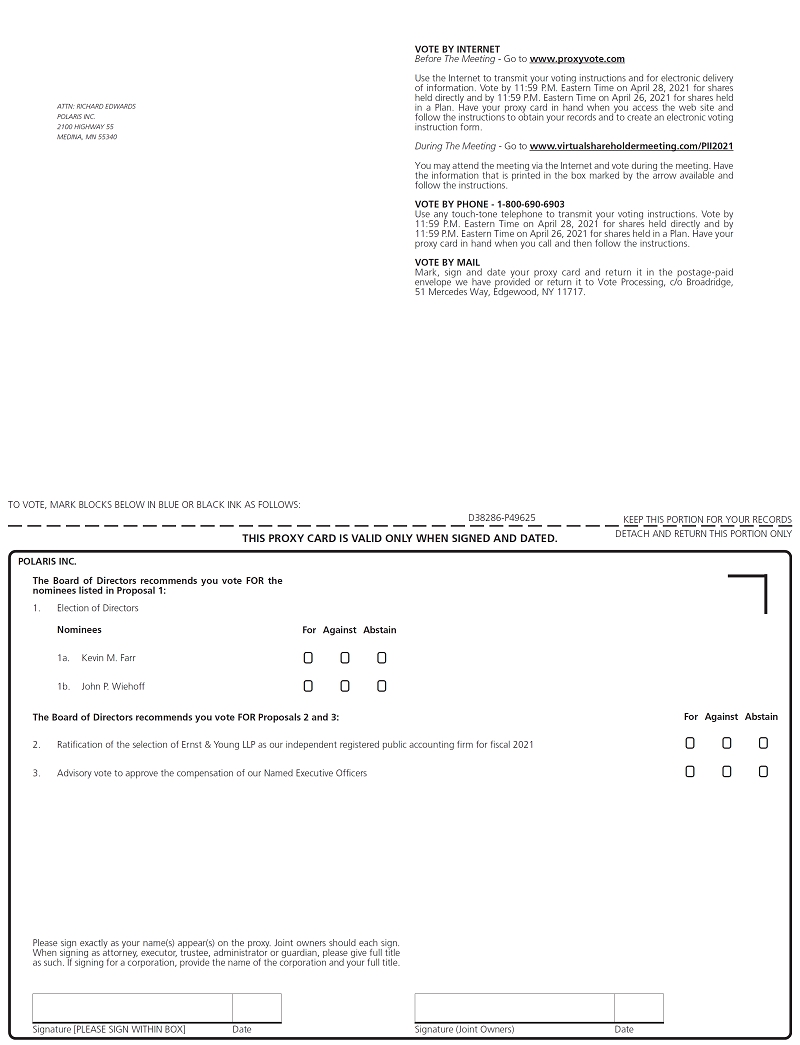

Elect twothree Class IIIII directors for three-year terms ending in 2024.2026.

Approve, on an advisory basis, the compensation of our Named Executive Officers.

Recommend, on an advisory basis, the frequency of future votes to approve the compensation of our Named Executive Officers.

Approve the reincorporation of the Company from Minnesota to Delaware.

Approve adoption of an exclusive forum provision in the Company’s Delaware Bylaws.

Approve adoption of officer exculpation provision in the Company’s Delaware Certificate of Incorporation.

Ratify the selection of Ernst & Young LLP as our independent registered public accounting firm for fiscal 2021.2023.

Approve, on an advisory basis, the compensation of our Named Executive Officers.

Act on any other matters that may properly come before the meeting.

Only shareholders of record at the close of business on March 1, 20216, 2023 may vote at the Annual Meeting or any adjournment thereof.

By Order of the Board of Directors

LucyClarkDougherty

SeniorVicePresident,—GeneralCounselChiefComplianceOfficer,andSecretary

March16,2021 15, 2023

How to Participate in the Virtual Annual Meeting | ||

PARTICIPATE VIA THE INTERNET |  VOTING DURING THE MEETING |  SUBMITTING QUESTIONS |

To attend the virtual meeting, visit www.virtualshareholdermeeting.com/ | To vote your shares during the meeting, click on the vote button provided on the screen and follow the instructions provided | Questions may be submitted live during the |

For technical assistance on the day of the Annual Meeting, call the support line at | ||

Other Ways to Vote Your Shares | ||

INTERNET |   TELEPHONE |   |

Go to http://www.proxyvote.com and follow the instructions (have the proxy card or internet notice in hand when you access the website) | Dial 1-800-690-6903 and follow the instructions (have the proxy card in hand when you call) | If you received paper copies of our proxy materials, mark your selection on the enclosed proxy card, date and sign your name, and promptly mail the proxy card in the postage-paid envelope provided |

Please see page | ||

YOUR VOTE IS IMPORTANT! IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE | ||

The Notice of Annual Meeting, our Proxy Statement for the | ||

20212023 Annual Meeting of Shareholders

DateandTime Thursday, April 9:00 a.m. Central Time |  Place www.virtualshareholdermeeting.com/ |  ProxyMailingDate March |  RecordDate March |

Proposals | Board Recommendation | Details |

• Proposal1 – Elect | FOR EACH NOMINEE | Page 26 |

• Proposal 2– Approve, on an advisory basis, the compensation of our Named Executive Officers | FOR | Page |

• Proposal 3– Recommend, on an advisory basis, the frequency of future votes to approve the compensation of our Named Executive Officers | ONE YEAR | Page 69 |

• Proposal 4 – Approve the reincorporation of the Company from Minnesota to Delaware | FOR | Page 70 |

•

| FOR | Page 85 |

• Proposal 6 – Approve adoption of officer exculpation provision in the Company’s Delaware Certificate of Incorporation | FOR | Page 87 |

• Proposal 7 – Ratify the selection of Ernst & Young LLP as our independent registered public accounting firm for fiscal | FOR | Page |

|

|

|

HOW TO |   INTERNET |   TELEPHONE |   |

Go to http://www.proxyvote.com and | Dial 1-800-690-6903 and follow the instructions (have the proxy card | If you received paper copies of our proxy materials, mark your selection on the enclosed proxy card, date and sign your name, and promptly mail the proxy card in the postage-paid envelope provided | |

Please see page | |||

Name | Age | Director Since | Independent | Audit Committee | Compensation Committee | Corporate Governance and Nominating Committee | Technology Committee(1) | Age | Director Since | Independent | Audit Committee | Compensation Committee | Corporate Governance and Nominating Committee | Technology & Innovation Committee |

Nominees for election at the 2021 Annual Meeting (Class III Term Ending 2024) | ||||||||||||||

Nominees for election at the 2023 Annual Meeting (Class II Term Ending 2026) | Nominees for election at the 2023 Annual Meeting (Class II Term Ending 2026) | |||||||||||||

George W. Bilicic* | 59 | 2017 | Yes | X |

| X |

| |||||||

Gary E. Hendrickson | 66 | 2011 | Yes |

| ✔ | X |

| |||||||

Gwenne A. Henricks | 65 | 2015 | Yes | X |

| X | ||||||||

|

|

| ||||||||||||

Directors with terms expiring 2024 (Class III) | Directors with terms expiring 2024 (Class III) | |||||||||||||

Kevin M. Farr* | 63 | 2013 | Yes | ✔ |

| X | 65 | 2013 | Yes | ✔ | X |

| ||

John P. Wiehoff(2) | 59 | 2007 | Yes |

| X | ✔ |

| |||||||

Darryl R. Jackson* | 62 | 2021 | Yes | X |

| X |

| |||||||

Michael T. Speetzen | 53 | 2021 | No |

| ||||||||||

John P. Wiehoff(1) | 61 | 2007 | Yes |

| X | ✔ |

| |||||||

|

|

|

| |||||||||||

Directors with terms expiring in 2022 (Class I) | ||||||||||||||

Directors with terms expiring 2025 (Class I) | Directors with terms expiring 2025 (Class I) | |||||||||||||

Bernd F. Kessler | 62 | 2010 | Yes |

| X | 64 | 2010 | Yes |

| X | ✔ | |||

Lawrence D. Kingsley | 58 | 2016 | Yes |

| X |

| X | 60 | 2016 | Yes |

| X |

| X |

Gwynne E. Shotwell | 56 | 2019 | Yes | X |

| X | 59 | 2019 | Yes | X |

| X | ||

| ||||||||||||||

Directors with terms expiring 2023 (Class II) | ||||||||||||||

George W. Bilicic* | 57 | 2017 | Yes | X |

| X | ||||||||

Gary E. Hendrickson | 64 | 2011 | Yes |

| ✔ | X |

| |||||||

Gwenne A. Henricks | 63 | 2015 | Yes | X |

| X | ||||||||

X Member ✔ Chair * Financial Experts (1) Annette K. Clayton is retiring from the Board at the 2021 Annual Meeting and therefore is not standing for re-election. Ms. Clayton will remain Chair of the Technology Committee until the 2021 Annual Meeting. (2) Board Chair | ||||||||||||||

X Member ✔ Chair * Financial Experts (1) Board Chair | X Member ✔ Chair * Financial Experts (1) Board Chair | |||||||||||||

| 6 |

At Polaris, we remain committed to being a customer-centric, highly efficient growth company.

Our senior management team, with oversight from our Board of Directors, has developed a clear visionSix Strategic Pillars: Best Customer Experience; Rider-Driven Innovation; Best Team,

Best Culture; Inspirational Brands; Agile & Efficient Operations; and strategyGeared for our long-term growth.Good

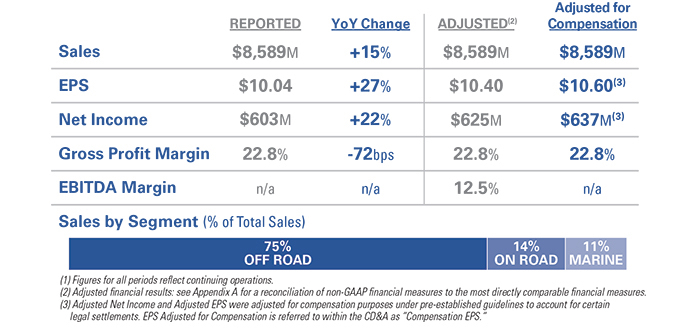

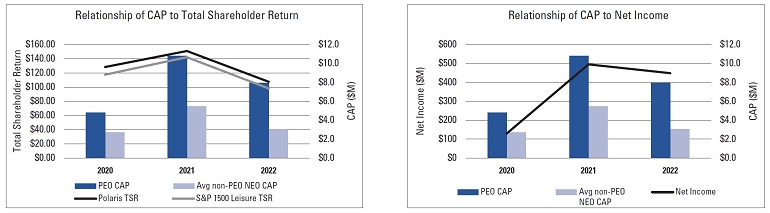

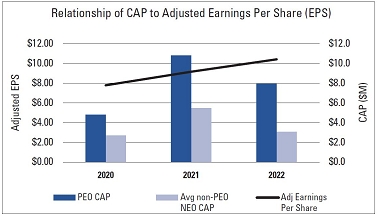

Our performance highlights from 20202022 demonstrate how we continue to successfully execute our strategy.

| 7 |

Our commitment to good corporate governance stems from our beliefAt Polaris, we believe that a strong governance framework creates long-term value for our shareholders, strengthens Board and management accountability, and builds trust in Polaris and its brands.

Board of DirectorsComposition

✔ | Independent Board and Committees, and | ✔ | Board oversight of risk management |

✔ | Majority voting standard for uncontested director elections | ✔ | Age limit of 72 for directors |

✔ | Executive sessions of independent directors before and/or after each Board meeting | ||

|

| ||

|

| ||

|

| ||

|

| ||

|

| ||

✔ | Non-employee director and executive stock ownership requirements | ||

✔ | Excellent meeting attendance | ✔ | Robust Code of Conduct applicable to all directors and executives |

✔ | Substantive annual Board and Committee self-evaluations | ✔ | “Clawback” policy for performance-based compensation |

Directors Have a Diverse Range of Qualifications and Skills

|

|

|

|

|

|

|

|

|

|

|

|

Our Board is committed to fostering direct and transparent engagements with our shareholders on many topics, including those related to executive compensation, corporate governance, human capital, and environmental and social issues. To that end, our Board has worked with management to develop an annual shareholder engagement process. These engagement efforts take place throughout the year involving a member of our Board (where requested), senior management, and shareholder representatives. In 2020, Polaris reached out to shareholders representing over 50% of our outstanding shares, and a member of our Board and management team met with a number of our shareholders.

| 8 |

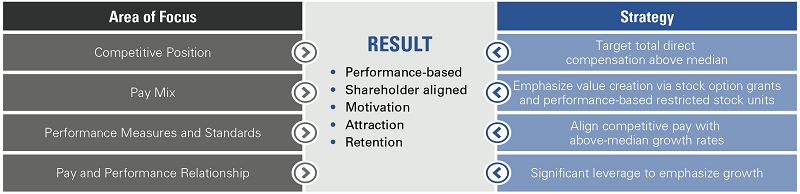

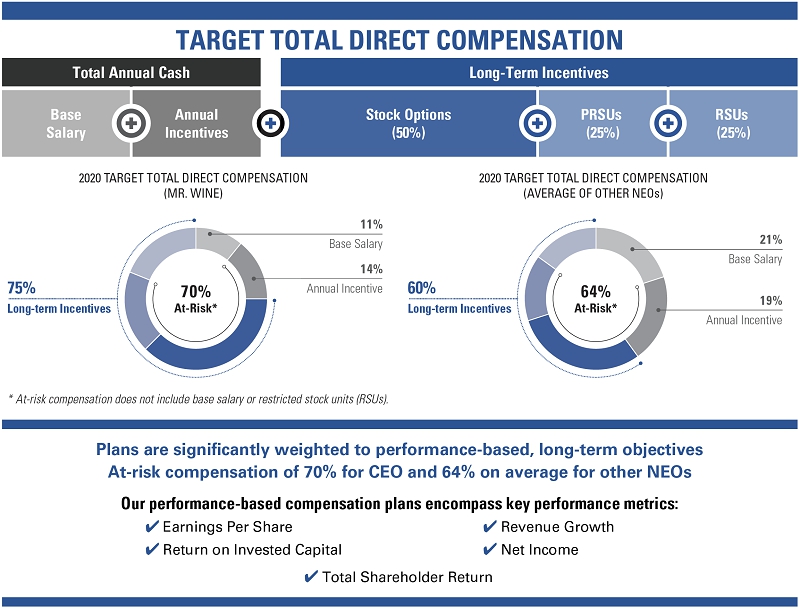

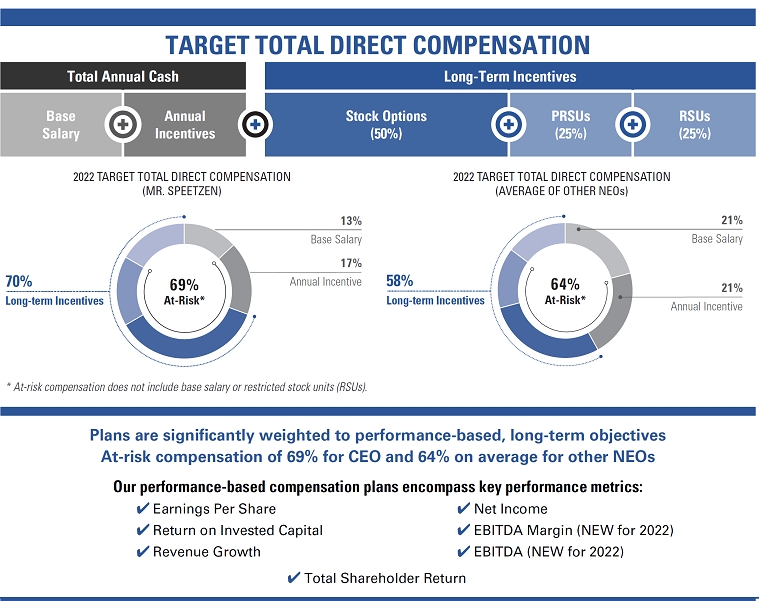

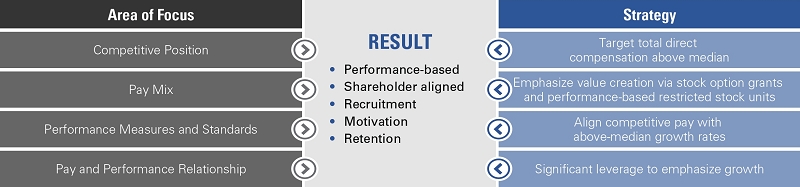

Our executive compensation philosophy aligns executive compensation decisions with our desired business direction, strategy and performance. The strategy and priorities of our compensation philosophy are the following:

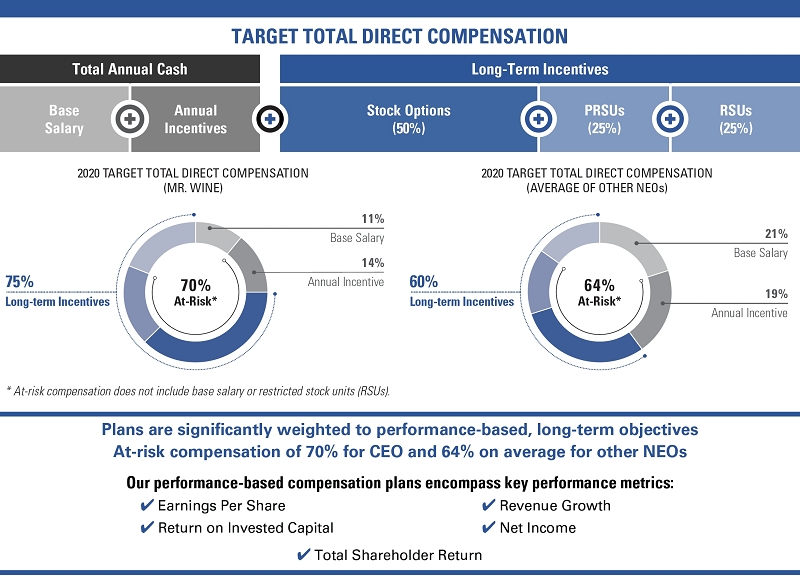

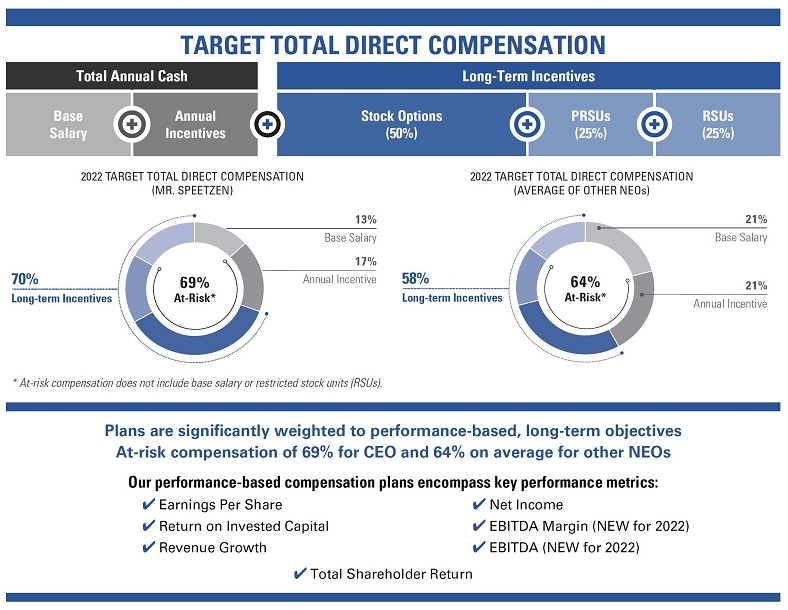

Our executive compensation program is based upon our compensation philosophy and is designed to incent our executives to pursue strategies and execute priorities that promote growth and deliver strong returns to shareholders. Below we illustrate the key components of our compensation program and the target total direct compensation.

| 2023 Proxy Statement - |   | 9 |

|

|

| Driven by innovation, integrity, and accountability, we continually tune to be good stewards for the industry, our employees, riders, |

| 2022 was the inaugural year for our Geared for Good Framework which identifies how we strategically consider environmental, social and governance (ESG) topics throughout Polaris. To | |

• THINK PRODUCT — Designing products and • THINK PRODUCTION — Operating facilities with consideration for people and the environment • THINK PLACES — Positively impacting land and water through stewardship and responsible riding • THINK PEOPLE — Putting employees, customers, dealers, and the communities where we live and work at the center of |

|

| ||

|  | |

|  |

As a part of our ongoing efforts to foster a workplace of awareness and understanding, we have an internal program called R.I.D.E. Together: Respect. Inclusion. Diversity. Equity. We believe that together, we can continue to build a diverse and inclusive workplace. Additionally, in 2023, in our continuous effort to “Think People,” we will be launching a newly established Employee Assistance Fund as |   |

| 10 |

As stewards of your investment in Polaris, theYour Board of Directors takes seriously its commitmentis committed to good corporate governance.governance, which it believes will enhance the long-term stability and value of the Company to the benefit of all stakeholders. The Board believes that transparent disclosure of its governance practices helps shareholders assess the quality and value of our Company. The Board is committed to enhancing the long-term stability and value of the Company to the benefit of all stakeholders.Company. By way of example, the Board’s corporate governance best practices include:

Independent Board and Committees, and independentIndependent Chair

Majority voting standard

Robust Chair responsibilities

Executive sessions of independent directors before and/or after each Board meeting

Senior executive succession planning

Substantive annual Board and committeeCommittee self-evaluations

Active shareholder engagement program

Non-employee director stock ownership requirements

Adherence to a robust Code of Conduct

“Clawback” policy for performance-based compensation

Age limit of 72 for directors (of 72)

Back Row:George Bilicic, John Wiehoff, Gary Hendrickson, Darryl Jackson, and Larry Kingsley.Front Row:Bernd Kessler, Gwenne Henricks, Mike Speetzen, Gwynne Shotwell, and Kevin Farr.

| 2023 Proxy Statement - |  | 11 |

Effective, Highly Engaged,Back to Contents

Our Board has adopted Corporate Governance Guidelines, which may be viewed online on our website at ir.polaris.com/investors/corporate-governance. The Corporate Governance Guidelines cover a range of topics, including director selection and Independent Board

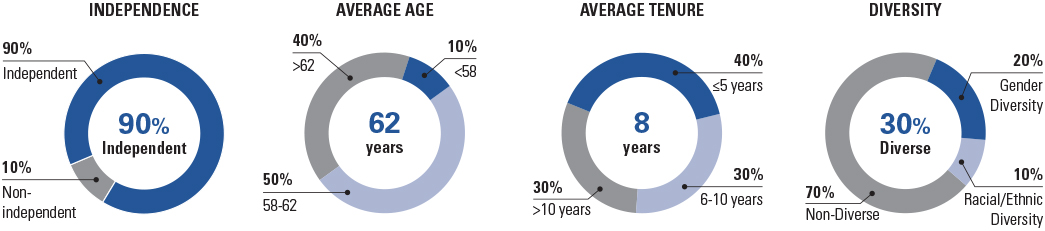

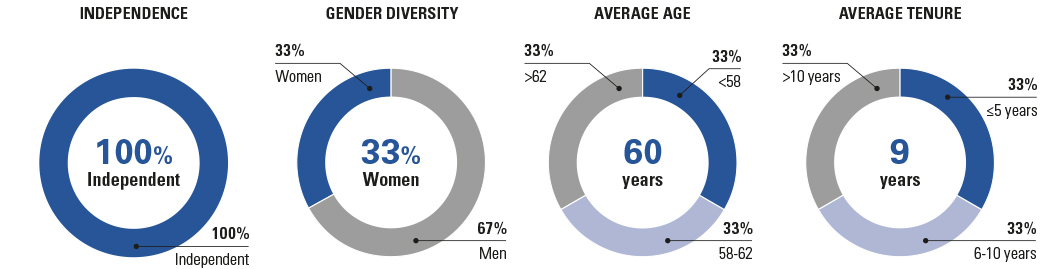

Our commitment to good corporate governance practices starts with our diverse, highly qualified,qualification, director responsibilities and engaged board.

In the last six years, the Company has added four new directors resulting in a Board with broad skill sets and backgrounds. Every year, we assess the composition of the Committeesoperation of the Board, director access to management and provide director education. Board refreshmentindependent advisors, succession planning, and effectiveness is driven by a regular and effective Board and Committee self-assessment process.the annual evaluations of the Board. In 2020, the Board amended the Corporate Governance Guidelines to provide thatincorporate additional measures based on a continuing review of best practices and shareholder feedback. The key changes included:

Director Diversity. We explicitly added gender and race as considerations for director selection.

Self-Evaluations. We vested in the Corporate Governance and Nominating Committee adviseoversight of the Board and its Committees on the evaluation processCommittee self-evaluation processes to drive consistency across the processes and to vest in one committee the task to think strategically about how they willto optimize the self-evaluation process. As part of that self-assessmentprocesses.

.

The Company’s comprehensive Board and Committee refreshment and succession planning process directors will provide anonymous and confidential feedback on topics including:

Board/Committee information and materials and meeting mechanics;

Board/Committee composition and structure;

Board/Committee responsibilities and accountability; and

Board meeting conduct and culture

To promote effectiveness ofis designed to enable the Board and each Committee to be comprised of highly qualified directors, with the resultsindependence, diversity, skills, and perspectives to provide strong and effective oversight. As a result of this process, in the last four years, the Company has added three new directors resulting in a Board with a comprehensive skill set relevant to our industry and future as well as resulting in a balanced mix of tenures.

Previously, in preparation for launching a director search and after a comprehensive Board self-evaluation led by a leading external firm, the Corporate Governance and Nominating Committee refreshed its skills matrix to identify the skills relevant to support the Company’s long-term strategy. Since that time, the Corporate Governance and Nominating Committee regularly reviews and refreshes its skills matrix so that the Board evaluation are reviewed and addressed byis comprised of directors with the full Board in an executive session led by the Chair. The results of each Committee’s evaluation are discussed at an executive session of the applicable Committee and further discussed by the full Board and senior management as appropriate.

Our Corporate Governance Guidelines provide that if a director reaches age 72 during his or her term of service, he or she will resign from the Board effective as of the Annual Meeting immediately following his or her 72nd birthday.

These practices enable directors’requisite skills and expertise to reflect the changing needs of our business andhelp support the execution of our long-term strategy. In the past, the Corporate Governance and Nominating Committee has retained a national executive and director search firm to assist the Board in conducting searches to identify potential qualified candidates to be considered for possible appointment to the Board. The independent search firm provided the Corporate Governance and Nominating Committee with background information on candidates as well as an assessment of the qualifications of the potential candidates. The Corporate Governance and Nominating Committee then evaluated and screened the candidates, including interviewing and reviewing the candidates against the criteria for selecting director nominees, including the specific skills discussed below, functional areas of experience, educational background, employment experience, diversity of perspective, and leadership performance. When the Corporate Governance and Nominating Committee deems it in the best interest of the Company strategy.to add a new director to the Board, the Committee expects to again retain a national executive director search firm to assist the Board in conducting a search.

The Corporate Governance and Nominating Committee seeks to achieve a balance of knowledge, experience and perspective on the Board and also evaluates intangible factors it deems appropriate to develop a heterogeneous and cohesive Board, considering characteristics such as integrity, judgment, diversity of thought, and intelligence, as well as the willingness and ability of the candidate to devote adequate time to Board duties for a sustained period.

In response to shareholder feedback, this year the Corporate Governance and Nominating Committee enhanced its skills matrix to identify skills attributable to each individual director and developed a new matrix to convey how each skill is aligned with each of Polaris’ six strategic pillars.

| 2023 Proxy Statement - |  | 12 |

Set forth below is a matrix highlighting how our Board skills are aligned with the Company’s six strategic pillars.

Strategic Pillars | ||||||

Board Skills | Best Customer Experience  | Inspirational Brands  | Rider-Driven Innovation  | Agile & Efficient Operations  | Best Team, Best Culture  | Geared For Good  |

Accounting and Financial Expertise | ✔ | |||||

Consumer Insights/Marketing Expertise | ✔ | ✔ | ✔ | ✔ | ||

Consumer/Manufacturing Industry Expertise | ✔ | ✔ | ✔ | |||

Corporate Governance Experience | ✔ | ✔ | ✔ | |||

Digital/E-Commerce Expertise | ✔ | ✔ | ✔ | ✔ | ||

Executive Leadership Experience | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

Global Experience | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

Innovation/Technology | ✔ | ✔ | ✔ | ✔ | ||

Legal Expertise | ✔ | ✔ | ||||

Product Quality and Safety Expertise | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

Regulatory/Compliance Expertise | ✔ | ✔ | ✔ | ✔ | ||

Risk Management/Oversight | ✔ | ✔ | ✔ | |||

Strategy and M&A | ✔ | ✔ | ✔ | ✔ | ||

| 2023 Proxy Statement - |  | 13 |

Our Board is comprised of individuals with a diverse mix of experience, backgrounds and skill sets that complement the Company’s long-term strategy. Our directors possess the professional and personal qualifications and attributes necessary to effectively oversee and guide our business and future direction. Set forth below is a matrix identifying the skills possessed by each individual director.

Director Skills | ||||||||||

George Bilicic | Kevin Farr | Gary Hendrickson | Gwenne Henricks | Darryl Jackson | Bernd Kessler | Lawrence Kingsley | Gwynne Shotwell | Michael Speetzen | John Wiehoff | |

Accounting and Financial Expertise | ✔ | ✔ | ✔ | ✔ | ✔ | |||||

Consumer/Manufacturing Industry Expertise | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ||

Consumer Insights/Marketing Expertise | ✔ | ✔ | ✔ | |||||||

Corporate Governance Experience | ✔ | ✔ | ✔ | ✔ | ✔ | |||||

Digital/E-Commerce Expertise | ✔ | |||||||||

Executive Leadership Experience | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

Global Experience | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

Innovation/Technology | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ||||

Legal Expertise | ✔ | |||||||||

Product Quality and Safety Expertise | ✔ | ✔ | ✔ | |||||||

Regulatory/Compliance Expertise | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | |||

Risk Management/Oversight | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

Strategy and M&A | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

Diversity | ||||||||||

Gender | ✔ | ✔ | ||||||||

Race/Ethnicity | ✔ | |||||||||

| 2023 Proxy Statement - |  | 14 |

We also recognize the value and strategic importance of Board diversity and that is reflected in our current Board makeup with 30% gender and racial diversity. The Corporate Governance and Nominating Committee considers, as required by its charter as well as the Company’s Corporate Governance Guidelines, the Board’s overall balance of diversity of perspectives, backgrounds, and experiences in areas relevant to the Company’s strategy when selecting Board nominees.nominees, as well as race and gender. In addition, as partrecognition of the Board’s amendments tovalue placed on diversity, when the Corporate Governance Guidelines in 2020, the Board added gender and race as specific considerations for director selection. The Corporate Governance and Nominating Committee viewsretains an independent search firm for a new director search, the Committee specifically requests the firm to include highly qualified candidates of diverse gender and race in the pool of candidates, as well as taking into account other factors that promote principles of diversity, broadlyincluding diversity of a candidate’s perspective, background, nationality, age and evaluates a wide range of criteria as it makesother demographics. The Board believes such diversity contributes to its selections, including, among others, functional areas of experience, educational background, employment experience,overall effectiveness.

| 2023 Proxy Statement - |  | 15 |

The Corporate Governance Guidelines provide that the Corporate Governance and Nominating Committee will advise the Board and its Committees on their evaluation process in an effort to drive consistency and to vest in one committee the task to think strategically about how to optimize the self-evaluation processes. In addition, the Board has retained a third-party independent consultant to conduct the Board evaluation. Below is a summary of our annual Board and Committee evaluation processes.

| Annual Board and Committee Evaluations |

| • The process is reviewed annually by the Corporate Governance and Nominating Committee. |

| • Written questionnaires are used for the Board and each Committee and are updated each year. Each director completes a written questionnaire for the Board and each Committee on which the director serves. The questionnaires include open-ended questions and space for candid commentary. Topics covered include: |

| › Board/Committee information and materials and meeting mechanics; |

| › Board/Committee composition and structure; |

| › Board/Committee interaction with management and with each other; |

| › Board/Committee responsibilities and accountability; and |

| › Board meeting conduct and culture. |

| • Additionally, the Chair of the Board and the Chair of each Committee conducts interviews with Board members to solicit additional feedback on Board and Committee performance and effectiveness. |

|

| Summary of Evaluations |

| • Reports are produced summarizing the written questionnaires and Chair interviews. |

| • All comments are unattributed, including those shared in the Chair interviews. |

|

| Board and Committee Review |

| • To promote effectiveness of the Board, the results of the annual Board evaluation are reviewed and addressed by the full Board in an executive session led by the Chair. |

| • The results of each Committee’s evaluation are discussed at an executive session of the applicable Committee and further discussed by the full Board and senior management as appropriate. |

|

| Actions Taken in Response to the Evaluations |

| • Streamlined Board and Committee materials. |

| • Enhanced director onboarding program. |

| • Increased director education on potential significant risks and corporate governance developments. |

| • Developed a detailed skills matrix to transparently reflect the skills and experiences of our Board which support our strategies. |

| • Reconstituted the Committee structures. |

| 2023 Proxy Statement - |  | 16 |

New directors participate in a comprehensive orientation which includes meetings with senior management to discuss the Company’s strategic plans, financial statements, legal and risk management, corporate responsibility (our Geared For Good framework) and key policies and practices, including best governance practices. In addition, the Corporate Governance and Nominating Committee regularly reviews and recommends topics for director training for the year. We encourage directors to participate in certain recommended external continuing director education programs and provide reimbursement for expenses associated with these events. Continuing director education is also assesses those intangible factors it deems necessaryprovided during Board meetings by outside experts who present on issues relevant to develop a heterogeneous and cohesivethe Board’s oversight duties. In 2022, outside experts presented to the Board on topics such as integrity, judgment, intelligence,electrification and the willingnessfuture of connected vehicles and ability of the candidatedata analytics. Finally, we provide directors with a quarterly memorandum summarizing relevant SEC, ESG and corporate governance developments.

We are committed to devote adequate time to Board duties for a sustained period. The Board is continually reassessing its composition to be sure that we have the right diversity of thought, experience, attributes, and background in our boardroom to advance the Company’s long-term strategy and to oversee the most important risks to that strategy.

|

having an independent Board. All current members of our Board, other than the CEO, are independent. Mr. Wine, our former Chief Executive Officer and former Chairman of the Board, was employed by the Company and therefore was not an independent director during his tenure on the Board under our Corporate Governance Guidelines orand the requirements of the New York Stock Exchange.Exchange (NYSE). To assure independence from management, members of the Board meet in executive session, without management, at the start and/or at the end of each regularly scheduled in-person meeting of the Board and each committee,Committee, and otherwise as deemed necessary.appropriate. These executive sessions allow directors to speak candidly on any matter of interest, without members of management present, and are a key element to our high functioninghigh-functioning Board.

| 2023 Proxy Statement - |  | 17 |

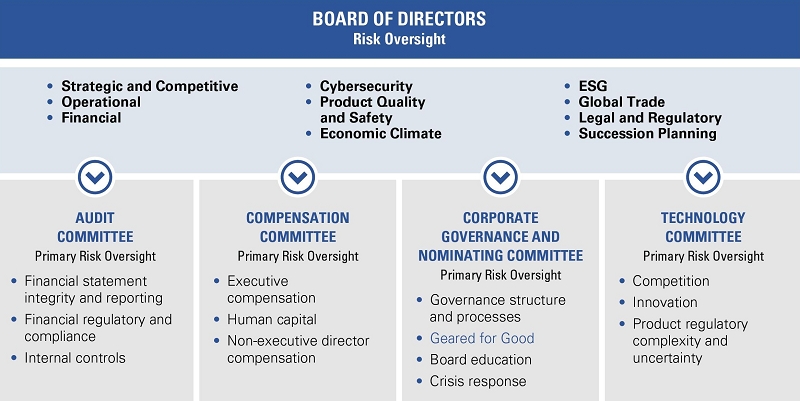

Our full Board has responsibility for overseeing the Company’s overall approach to risk management and is actively engaged in addressing the most significant risks facing the Company. While the Board and its Committees oversee key risk areas, the Company’s management is responsible for day-to-day risk management identification and mitigation, as well as bringing to the Board’s attention emerging risks and highlighting the top enterprise risks.

The Board’s oversight of the Company’s most common risks is structured as follows:

To learn more about the risks facing the Company, please see the risks described in Item 1A. Risk Factors in the Company’s 2022 Annual Report on Form 10-K. The risks described in the Company’s 2022 Annual Report are not the only risks facing the Company.

| 2023 Proxy Statement - |  | 18 |

The Board receives and discusses regular reports on sustainability and corporate responsibility matters, including those related to safety, human capital management, innovation and technology, and sustainability initiatives across the Company. The Company’s Corporate Responsibility Committee members include the CEO, CFO and CHRO and reflect the cross-functional nature of corporate responsibility matters and leverage expertise across our executive team in areas such as Supply Chain, Investor Relations, Human Resources, Manufacturing, Legal, Environment, Health and Safety, and Finance. The Committee is chaired by the General Counsel of the Company. The purpose of the Corporate Responsibility Committee is to advise the Company on matters of significance to the Company and its stakeholders concerning corporate social responsibility and sustainability and to assist the Company’s Board and senior management team in addressing the impact of these matters on the Company’s business, strategies, operations, performance and reputation.

Under the oversight of the Corporate Responsibility Committee and with input from the Board, in 2022 we published our annual Corporate Responsibility Report, which sets forth our ESG priorities, our performance in these areas, and targets for future improvement. For additional information, please see the Corporate Responsibility page in the Proxy Statement Summary.

The Company’s cybersecurity program is designed to identify and mitigate cybersecurity risk to enable profitable growth and enhance the reputation of the Company as an ethical, customer-centric company. Our program structure and governance is aligned with industry-standard cybersecurity frameworks and includes our Executive Cybersecurity Council that meets as appropriate and is chaired by the Company’s Senior Vice President and Chief Digital and Information Officer. The full Board also receives regular reports on cybersecurity matters, including the Company’s incident response process. As cyber threats are ever evolving, we work to continuously improve the governance, scope, and maturity of our cybersecurity program.

| 2023 Proxy Statement - |  | 19 |

Our Board has worked with management to develop an annual shareholder engagement process. These engagement efforts take place throughout the year and involve a member of our Board, when requested, senior management, and shareholder representatives. In 2022, Polaris reached out to shareholders representing almost 70% of our outstanding shares, and the management team met with shareholders owning almost 35% of our outstanding shares. The meeting agendas included discussions on various topics, including the Company’s strategy, compensation philosophy, diversity and inclusion initiatives, human capital management, sustainability efforts, product safety and quality, governance practices, and board refreshment. After the engagements, management summarizes the feedback received and then reviews the feedback with the Corporate Governance and Nominating Committee and, when relevant, the Compensation Committee and, as appropriate, the Chair of the Corporate Governance and Nominating Committee and of the Compensation Committee review the concerns and recommendations identified by our shareholders with the full Board.

The feedback from these meetings helps inform the Board and management on shareholder priorities and concerns. We listen carefully to our shareholder feedback and, when appropriate, we make changes to address concerns and/or align with best practices. For example, in 2021, our shareholders requested disclosure of an enhanced skills matrix identifying the skills attributable to each individual director in our proxy statement, so this year we refined and enhanced our skills matrix as included herein. In addition, shareholders requested that we refresh our materiality assessment and set more rigorous environmental goals, and, in 2022, we completed a second materiality assessment and will be announcing our new environmental goals in our 2022 Corporate Sustainability Report expected to be released in May 2023.

OUR SHAREHOLDER ENGAGEMENT PROCESS

| Assess and Prepare | Outreach and Engagement | |

• We assess and monitor: › Investor policies and stewardship priorities › Shareholder voting results › Trends in governance, executive compensation, environmental, social, regulatory, and other matters • We identify and prepare for potential topics that are priorities for our shareholders | • We reach out to our largest shareholders to request engagement • Our management team and a member of our Board, when requested, meet with shareholders to actively solicit input on issues relevant to our shareholders and provide insight on the company’s policies and strategy | |

| Evaluate | Respond | |

• Our Board and management team review shareholder input and assess any issues or concerns identified • Shareholder input and policies are continuously reviewed and considered when implementing best governance practices by our Board and Committees | • Our Board responds and, when appropriate, takes action to align with shareholder feedback • We enhance our disclosure to provide greater transparency on topics significant to our shareholders • In 2022, responses included: › Enhancing our skills matrix in this year’s proxy to identify skills attributable to each individual director and adding a matrix to convey how each skill is aligned with each of Polaris’ six strategic pillars › Completing our second materiality assessment › Setting more rigorous environmental goals which will be announced in our 2022 Corporate Sustainability Report expected to be released in May 2023 |

| 2023 Proxy Statement - |  | 20 |

Our independent Chair of the Board is Mr. Wiehoff. Throughout 2020 and until Mr. Wine’s departure from the Company effective December 31, 2020, Mr. Wine served as both Chief Executive Officer and Chairman of the Board. After Mr. Wine’s departure, the Board determined that it was in the best interests of the Company to have the Board led by an independent Chair and elected Mr. Wiehoff to assume that role. The Board believes that an effective leadership structure could be achieved either by combining or separating the Chair and Chief Executive Officer (CEO) positions, so long as the structure encourages the free and open dialogue of competing views and provides for strong checks and balances. Specifically, the Board believes that to be effective, the governance structure must balance the powers of the Chief Executive OfficerCEO and the independent directors and enable the independent directors to be fully informed, able to discuss and debate the issues that they deem important and able to provide effective oversight of management. The Board of Directors believes that the separation of the Chair and Chief Executive OfficerCEO roles is appropriate for us at this time because it allows our interim Chief Executive OfficerCEO to focus on executing on Company priorities while the independent Chair focuses on leadership of the Board of Directors.Board. The Board routinely reassesses the leadership structure of the Board and has the flexibility to choose a different Board leadership structure if and when it believes circumstances warrant.

The duties and responsibilities of the independent Chair, among others, include:

CHAIR DUTIES AND RESPONSIBILITIES | |

• Presides over Board executive sessions of independent directors | •

|

• Serves as the liaison between the CEO and independent directors | • Has authority to call meetings of independent directors |

• If requested by major shareholders, is available for consultation and direct communication | • Conducts and facilitates annual Board self-evaluation |

• Communicates with the CEO about strategic business issues, government processes and board relationships | • Coordinates with the Compensation Committee on the CEO evaluation |

During 2020,2022, the full Board met eleven5 times. Each of the meetings wasMeetings are typically preceded and/or followed by an executive session of the Board without management in attendance, chaired by Mr. Wiehoff. Each of our directors attended at least 75 percent of the meetings of the Board and any committeeCommittee on which that director served in 2020.2022. We do not maintain a formal policy regarding the Board’s attendance at annual shareholder meetings; however, Board members are expected to regularly attend all Board meetings and meetings of the committeesCommittees on which they serve as well as the annual shareholder meetings. All members of the Board attended our 20202022 Annual Meeting.

| |

The Board has designated four standing committees:Committees: the Audit Committee, the Compensation Committee, the Corporate Governance and Nominating Committee, and the Technology & Innovation Committee. Each committeeCommittee operates under a written charter which is available on our website at ir.polaris.com/investors/corporate-governance.corporate-governance. The current membership of each committeeCommittee and its principal functions, as well as the number of times it met during 2020,2022, are described below.

| Board | Audit | Compensation | Corporate Governance and Nominating | Technology |

George W. Bilicic* | X | X |

| X | X |

Annette K. Clayton | X |

| X |

| ✔ |

Kevin M. Farr* | X | ✔ |

|

| X |

Gary E. Hendrickson | X |

| ✔ | X |

|

Gwenne A. Henricks | X | X |

|

| X |

Bernd F. Kessler | X |

|

| X | X |

Lawrence D. Kingsley | X |

| X |

| X |

Gwynne E. Shotwell | X | X |

|

| X |

John P. Wiehoff | ✔ |

| X | ✔ |

|

Number of fiscal year 2020 meetings | 11 | 10 | 5 | 2 | 3 |

X Member ✔ Chair * Financial Experts | |||||

| Board | Audit | Compensation | Corporate Governance and Nominating | Technology & Innovation |

George W. Bilicic* | X | X |

| X |

|

Kevin M. Farr* | X | ✔ | X |

|

|

Gary E. Hendrickson | X |

| ✔ | X |

|

Gwenne A. Henricks | X | X |

|

| X |

Darryl R. Jackson* | X | X |

| X |

|

Bernd F. Kessler | X |

|

| X | ✔ |

Lawrence D. Kingsley | X |

| X |

| X |

Gwynne E. Shotwell | X | X |

|

| X |

Michael T. Speetzen | X |

|

|

|

|

John P. Wiehoff | ✔ |

| X | ✔ |

|

Number of fiscal year 2022 meetings | 5 | 9 | 5 | 4 | 2 |

X Member ✔ Chair * Financial Experts | |||||

AuditCommittee(1)

Members: Kevin M. Farr, Chair George W. Bilicic Gwenne A. Henricks Darryl R. Jackson Gwynne E. Shotwell

Number of Meetings | Functions: The Audit Committee assists the Board in fulfilling its fiduciary responsibilities by overseeing our financial reporting and public disclosure activities. The Audit Committee’s primary purposes and responsibilities are to: • Assist the Board • Prepare the Audit Committee Report that appears later in this Proxy Statement; • Serve as an independent and objective party to oversee our financial reporting process and internal control system; and • Provide an open avenue of communication among the independent auditor, financial and senior management, the internal auditors and the Board. The Audit Committee, in its capacity as a committee of the Board, is directly responsible for the appointment, compensation and oversight of the work of any independent registered public accounting firm engaged by us (including resolution of any disagreements between management and the independent auditor regarding financial reporting) for the purpose of preparing or issuing an audit report or related work or performing other audit, review or attestation services for us, and each such independent registered public accounting firm reports directly to the Audit Committee. |

All members of the Audit Committee have been determined to be “independent” and “financially literate” by the Board in accordance with our Corporate Governance Guidelines, rules of the United States Securities and Exchange Commission (the SEC), and the applicable listing requirements of the New York Stock Exchange (NYSE). Additionally, Messrs. Bilicic, Farr, and FarrJackson have each been determined by the Board to be an “Audit Committee Financial Expert” as that term has been defined by the SEC. None of the members of the Audit Committee currently serve on the audit committees of more than three public companies.

| |

Compensation Committee(2)

Members: Gary E. Hendrickson, Chair

Lawrence D. Kingsley John P. Wiehoff

Number of Meetings | Functions: The Compensation Committee assists the Board in establishing a philosophy and policies regarding director and executive compensation, oversees the Company’s human capital strategy (to the extent not covered by the full Board), provides oversight to the administration of our director and executive compensation, administers our equity-based and cash incentive plans, reviews and approves the compensation of executive officers and senior management, reviews and recommends the compensation of the directors to the Board, reviews and discusses the Compensation Discussion and Analysis included in this Proxy Statement with management, and prepares the Compensation Committee Report that appears later in this Proxy Statement. The Compensation Committee generally may delegate its duties and responsibilities to a subcommittee of the Compensation Committee. To the extent consistent with applicable law, and subject to certain limitations, the Compensation Committee may also delegate grant authority under our 2007 Omnibus Incentive Plan to our officers. Use of Compensation Consultant The Compensation Committee has the authority to retain independent counsel and other independent experts or consultants. The Compensation Committee engaged Willis Towers Watson to act as its compensation consultant again in |

CorporateGovernanceandNominatingCommittee(3)

Members: John P. Wiehoff, Chair George W. Bilicic Gary E. Hendrickson Darryl R. Jackson Bernd F. Kessler

Number of Meetings | Functions: The Corporate Governance and Nominating Committee provides oversight and guidance to the Board to make certain that the membership, structure, policies and processes of the Board and its committees facilitate the effective exercise of the Board’s role in the governance of our Company. The |

Technology & Innovation Committee Members: Bernd F. Kessler, Chair Gwenne A. Henricks Lawrence D. Kingsley Gwynne E. Shotwell Number of Meetings | Functions: The Technology & Innovation Committee provides oversight of the Company’s innovation and technology development as they relate to emerging capabilities and technology insertion strategies for our product plans. The Committee reviews competitive technologies, trend analyses, competitive advantages and competitive technology analyses to drive innovation priorities. |

All members of the Compensation Committee have been determined to be “independent” by the Board in accordance with our Corporate Governance Guidelines and the applicable listing requirements of the NYSE.

All members of the Corporate Governance and Nominating Committee have been determined to be “independent” by the Board in accordance with our Corporate Governance Guidelines and the applicable listing requirements of the NYSE.

| |

|

|

Our full Board has responsibility for overseeing the Company’s overall approach to risk management and is actively engaged in addressing the most significant risks facing the Company. While the Board and its committees oversee key risk areas, the Company’s management is responsible for day-to-day risk management identification and mitigation, as well as bringing to the Board emerging risks and highlighting the top enterprise risks.

Management identifies enterprise risks by engaging in an Enterprise Risk Management (ERM) process. The ERM process consists of periodic risk assessments performed during the year by finance, legal, regulatory, and other functional expertise, in partnership with the business units. Finance executives present the ERM conclusions to the Audit Committee. As appropriate, key risks are then discussed at the Board. The Company maintains regular internal risk management meetings, assigns operating risk owners with accountability for specific risk management activities, promulgates its Code of Conduct (which is approved by the Board), maintains a strong legal department and ethics and compliance office and a comprehensive internal and external audit process. The Board believes that these processes and division of responsibilities is the most effective approach for addressing the risks facing our Company.

The Board’s oversight of the Company’s most common risks is structured as follows:

|

Our Board has worked with management to develop an annual shareholder engagement process. These engagement efforts take place throughout the year involving a member of our Board (where requested), senior management, and shareholder representatives. In 2020, Polaris reached out to shareholders representing over 50% of our outstanding shares, and a member of our Board and management team met with a number of our shareholders. The meeting agendas included discussions on various topics, including the Company’s response to COVID-19, company strategy, compensation, human capital management, governance practices, ESG and board refreshment. After the engagements, management summarizes the feedback received and then reviews the feedback with the Corporate Governance and Nominating Committee and the Compensation Committee and, as appropriate, the Chair of the Corporate Governance and Nominating Committee reviews the concerns and recommendations identified by our shareholders with the full Board. The feedback from these meetings helps inform the Board and management on shareholder priorities and concerns. We listen carefully to our shareholder feedback and, when appropriate, we make changes to address concerns and/or align with best practices. We will continue to prioritize our shareholder engagements to determine what is in the best interests of Polaris and our stakeholders.

Corporate Governance Guidelines and Independence

Our Board has adopted Corporate Governance Guidelines, which may be viewed online on our website at ir.polaris.com/investors/corporate-governance. In 2020, the Board amended our Corporate Governance Guidelines to incorporate additional best governance practices. The key changes included:

DirectorDiversity. Added gender and race as considerations for director selection.

Overboarding. Added a provision that new directors who are public company executives should only serve on two public company boards (including the Company’s Board).

Self-Evaluations. Provided that the Corporate Governance and Nominating Committee advise the Board and committees on the self-evaluation processes to drive consistency across the processes and to vest in one committee the task to think strategically about how to optimize the self-evaluation process.

LeadIndependentDirector. If the Board decides to appoint a Lead Independent

CodeofConduct: Added a specific reference to directors’ requirement to abide by the Company’s Code of Conduct.

Under our Corporate Governance Guidelines, which adopt the current standards for “independence” established by the NYSE, a majority of the members of the Board must be independent as determined by the Board. In making its determination of independence, among other things, the Board must have determined that the director has no material relationship with the Company either directly or indirectly as a partner, shareholder or officer of an organization that has a relationship with us. The Board of Directors has determined that directors Bilicic, Clayton, Farr, Hendrickson, Henricks, Jackson, Kessler, Kingsley, Shotwell, and Wiehoff are independent. Accordingly, our entire Board, other than the CEO, and all members of our Audit Committee, Compensation Committee, and Corporate Governance and Nominating Committee are considered to be independent. Mr. Wine,Speetzen, our former Chief Executive OfficerCEO and former Chairman of thea Board wasmember, is employed by the Company and therefore wasis not an independent director during his tenure on the Board under our Corporate Governance Guidelines or the requirements of the New York Stock Exchange.NYSE standards.

The Board based its independence determinations, in part, upon a review by the Corporate Governance and Nominating Committee and the Board of certain transactions between the Company and companies with which certain of our directors have relationships, each of which was made in the ordinary course of business, at arm’s length, at prices and on terms customarily available to unrelated third party vendors or customers generally, in amounts that are not material to our business or the business of such unaffiliated corporation, and in which the director had no direct or indirect personal interest, nor received any personal benefit. Specifically, the Corporate Governance and Nominating Committee and the Board reviewed ordinary course of business purchases by us from C.H. Robinson Worldwide, where Mr. Wiehoff was Chair of the CEOBoard for 2018 and a portion of fiscal 2019. The2020, ordinary course of business purchases by us from US Bancorp and Donaldson Company, Inc., where Mr. Wiehoff is a director, and ordinary course of business purchases of our products by Space Exploration Technologies Corp., where Ms. Shotwell is President and Chief Operating Officer. All of these payments were less than the greater of $1,000,000 or 2% of the recipient’s gross revenues in fiscal 20182020, 2021 and 2019.2022.

During 2022, we did not engage in any transactions with related persons that are required to be described in this Proxy Statement pursuant to applicable SEC regulations.

Our written Related-Person Transactions Policy, which is applicable to all of our directors, nominees for directors, executive officers and 5% shareholders and their respective immediate family members, prohibits “related-person transactions” unless approved by the Corporate Governance and Nominating Committee.

Matters considered to be a related-person transaction subject to the policy include any transaction in which we are directly or indirectly a participant and the amount involved exceeds or reasonably can be expected to exceed $120,000, and in which a director, nominee for director, executive officer or 5% shareholder, or any of their respective immediate family members, has or will have a direct or indirect material interest.

Any potential related-person transaction that is raised will be analyzed by the General Counsel, in consultation with management and with outside counsel, as appropriate, to determine whether the transaction or relationship constitutes a related-person transaction requiring compliance with the policy. The potential related-person transaction and the General Counsel’s conclusion and the analysis thereof are also to be reported to the Chair of the Corporate Governance and Nominating Committee.

The Corporate Governance and Nominating Committee reviews the material facts of all related-person transactions that require the Committee’s approval and either approve or disapprove of the related person transaction. If advance Committee approval of a related-person transaction is not feasible, then the related-person transaction is considered and, if the Committee determines it to be appropriate, ratified at the Committee’s next regularly scheduled meeting. Any related-person transaction that is not approved or ratified, as the case may be, is voided, terminated or amended, or such other actions shall be taken, in each case as determined by the Committee, to avoid or otherwise address any resulting conflict of interest.

| |

We have adopted a Code of Business Conduct and Ethics applicable to all employees, including our CEO, our Chief Financial Officer (CFO) and all other executive officers, and the Board. The full Board received Code of Conduct training in 2022. A copy of the Polaris Code of Business Conduct and Ethics is available on our website at ir.polaris.com/investors/corporate-governance. If we waive any of the provisions of the Polaris Code of Business Conduct and Ethics with respect to the CEO, CFO, any executive officer or member of the Board that relates to any element of the definition of “code of ethics” enumerated in Item 406(b) of Regulation S-K under the Securities and Exchange Act of 1934, as amended (the Exchange Act), we intend to disclose such actions on our website at the same location.

We adopted a policy that prohibits directors and executive officers from engaging in speculative trading of the Company’s securities. Specifically, no officer or member of the Board of Directors may purchase any financial instruments (including prepaid variable forward contracts, equity swaps, collars, and exchange funds) that are designed to hedge or offset any decrease in the market value of securities of the Company held directly, or indirectly, by the officer or director. We also adopted a policy that prohibits directors and executive officers to pledge our common stock as collateral for a loan except where the transaction is pre-approved by the Company’s General Counsel and CFO. The director or executive officer must clearly demonstrate the financial capacity to repay the loan without resorting to the pledged securities. No directors or executive officers pledged shares of common stock during 2020.2022.

Under our Corporate Governance Guidelines, a process has been established by which shareholders and other interested parties may communicate with members of the Board. Any shareholder or other interested party who desires to communicate with the Board, individually or as a group, may do so by writing to the intended member or members of the Board, c/o Corporate Secretary, Polaris Inc., 2100 Highway 55, Medina, Minnesota 55340.55340, or by sending an email to PolarisCorporate.Secretary@polaris.com.

All communications received in accordance with these procedures will be reviewed initially by the office of our Corporate Secretary to determine whether the communication is a message to one or more of our directors and then will be relayed to the appropriate director or directors unless the Corporate Secretary determines that the communication is an advertisement or other promotional material. The director or directors who receive any such communication will have discretion to determine whether the subject matter of the communication should be brought to the attention of the full Board or one or more of its committees and whether any response to the person sending the communication is appropriate.

Certain Relationships and Related Transactions

During 2020, we did not engage in any transactions with related persons that are required to be described in this Proxy Statement pursuant to applicable SEC regulations.

Our written Related-Person Transactions Policy, which is applicable to all of our directors, nominees for directors, executive officers and 5% shareholders and their respective immediate family members, prohibits “related-person transactions” unless approved or ratified by the Corporate Governance and Nominating Committee.

Matters considered to be a related-person transaction subject to the policy include any transaction in which we are directly or indirectly a participant and the amount involved exceeds or reasonably can be expected to exceed $120,000, and in which a director, nominee for director, executive officer or 5% shareholder, or any of their respective family members, has or will have a direct or indirect material interest.

Any potential related-person transaction that is raised will be analyzed by the General Counsel, in consultation with management and with outside counsel, as appropriate, to determine whether the transaction or relationship constitutes a related-person transaction requiring compliance with the policy. The potential related-person transaction and the General Counsel’s conclusion and the analysis thereof are also to be reported to the chair of the Corporate Governance and Nominating Committee.

The Corporate Governance and Nominating Committee reviews the material facts of all related-person transactions that require the committee’s approval and either approve or disapprove of the related person transaction. If advance committee approval of a related-person transaction is not

|

feasible, then the related-person transaction is considered and, if the committee determines it to be appropriate, ratified at the committee’s next regularly scheduled meeting. Any related-person transaction that is not approved or ratified, as the case may be, is voided, terminated or amended, or such other actions shall be taken, in each case as determined by the committee, to avoid or otherwise address any resulting conflict of interest.

Delinquent Section 16(a) Reports

Section 16(a) of the Exchange Act requires our directors and executive officers to file initial reports of ownership and reports of changes of ownership of our common stock with the SEC. Executive officers and directors are required to furnish us with copies of all Section 16(a) reports that they file. To our knowledge, based solely upon a review of the reports filed by the executive officers and directors during 2020 and written representations that no other reports were required, we believe that during the year ended December 31, 2020, all filing requirements applicable to our directors, executive officers and 10% beneficial owners, if any, were complied with on a timely basis, except that the Company inadvertently failed to timely report shares withheld to pay a tax liability related to a restricted stock unit award held by Mr. Menneto on December 1, 2020, which report was filed on December 4, 2020.

| |

Our directors bring a broad range of leadership and experience to the boardroom and regularly contribute to the dialogue involved in effectively overseeing and guiding our business and affairs. AllOther than our CEO, all of the members of the Board are independent. Preparation, engagement and participation are expected from our directors. We insist ondirectors, as well as high personal and professional ethics, integrity and values. All of our current directors and the director nominees satisfy such requirements. The Board has adopted Corporate Governance Guidelines, which are observed by all directors. With a diverse mix of experience, backgrounds and skill sets that complement the Company’s long-term strategy, the Board believes it is well positioned to represent the best interests of the Company’s shareholders. The principal occupation, specific experience, qualifications, attributes or skills and certain other information about the nominees and other directors whose terms of office continue after the Annual Meeting are set forth on the following pages.

If a shareholder wishes to have the Corporate Governance and Nominating Committee consider a candidate for nomination as a director, the shareholder’s notice must include the information specified in our bylaws, including the shareholder’s name and address, the information required to be disclosed by the SEC’s proxy rules, a written consent of the candidate to be named in the proxy statement and to serve as a director if elected, specified information regarding the shareholder’s interests in our capital stock, and the representations specified in our bylaws. The Corporate Governance and Nominating Committee will evaluate recommended nominees based on the factors identified in the Corporate Governance and Nominating Committee Charter, a copy of which is available on our website at ir.polaris.com/investors/corporate-governance. Alternatively, shareholders may directly nominate a person for election to our Board by complying with the procedures set forth in our bylaws, any applicable rules and regulations of the SEC and any other applicable laws. From time-to-time, the Corporate Governance and Nominating Committee works with third party search firms to assist in the identification and evaluation of potential director candidates and will also consider any director candidates submitted by other stakeholders (subject to the terms of the Company’s bylaws).

| |

Age 59

INDEPENDENT

Committees: •

|

| GEORGE W. BILICIC |

Skills and Qualifications: | ||

•

• • Executive Leadership Experience • Global Experience • Innovation/Technology •Legal Expertise • Regulatory/Compliance Expertise • Risk Management/Oversight • Strategy and M&A

|

| |

Other Current Public Company Directorships: • None | Former Public Company Directorships Held during the Past 5 Years: • None | |

| ||

|

| |

| ||

|

| |

|

| |

| ||

|

|

| |

| ||

|

| |

|

| |

Mr. Bilicic has | ||

Age 66

INDEPENDENT

Committees: • Compensation, Chair • Corporate Governance and Nominating | GARY E. HENDRICKSON | |

Skills and Qualifications: | ||

• • Consumer/Manufacturing Industry Expertise • Corporate Governance Experience • Executive Leadership

•Global Experience • Regulatory/Compliance Expertise • Risk Management/Oversight • Strategy and M&A

|

| |

Other Current Public Company Directorships: •

The AZEK Company Inc. | Former Public Company Directorships Held during the Past 5 Years: •

| |

Mr. Hendrickson has served as the Chairman of the Board of The AZEK Company Inc., a manufacturer of residential and commercial products, since May 2017. He served as Chairman and Chief Executive Officer of The Valspar Corporation, a global paint and coatings manufacturer, from June 2011 to June 2017, and was its President and Chief Operating Officer from February 2008 until June 2011. He held various executive leadership roles with The Valspar Corporation since 2001 including positions with responsibility for the Asia Pacific operations. | ||

Age 65

INDEPENDENT

Committees: • Audit •

| GWENNE A. HENRICKS | |

Skills and Qualifications: | ||

• • Executive Leadership Experience • • Innovation/Technology •

| Product Quality and Safety Expertise • Regulatory/Compliance Expertise • Risk Management/Oversight • Strategy and M&A

| |

Other Current Public Company Directorships: • None | Former Public Company Directorships Held during the Past 5 Years: • None | |

Ms. Henricks served as Vice President, Product Development & Global Technology, and Chief Technology Officer of Caterpillar Inc., a world leading manufacturer of construction and mining equipment, diesel and natural gas engines, industrial gas turbines and diesel-electric locomotives, from 2012 to 2016. She joined Caterpillar in 1981 in an engineering role and held numerous engineering and executive roles progressing in scope and complexity. Ms. Henricks serves on the Board of Decision Sciences International Corporation and the Bradley University Engineering Advisory Committee. | ||

| |

Age 65

INDEPENDENT

Committees: •

Audit, Chair • Compensation

|

| KEVIN M. FARR |

Skills and Qualifications: | ||

• • Consumer/Manufacturing Industry Expertise • Executive Leadership

| •

Global Experience | |

• Regulatory/Compliance Expertise • Risk Management/Oversight • Strategy and M&A Other Current Public Company Directorships: • None | Former Public Company Directorships Held during the Past 5 Years: • None Mr. Farr served as Chief Financial Officer of ChromaDex Corp., a science-based nutraceutical company, from October 2017 until August 2022. He previously served as Executive Vice President and Chief Financial Officer of Mattel, Inc., a world-wide leader in the design, manufacture, and marketing of toys and family products, from February 2000 through September 2017, and prior to that served in multiple leadership roles at Mattel, Inc. beginning in 1991. Before joining Mattel, Inc., Mr. Farr spent 10 years at Pricewaterhouse Coopers. He serves on the Board of West Los Angeles Ronald McDonald House Charities and the Board of Southern California Special Olympics. |

Age 62 INDEPENDENT Committees: • Audit • Corporate Governance & Nominating | DARRYL R. JACKSON | |

Skills and Qualifications: • Accounting and Financial Expertise • Consumer Insights/Marketing Expertise • Consumer/Manufacturing Industry Expertise • Digital/E-Commerce Expertise • Executive Leadership Experience • Global Experience • Regulatory/Compliance Expertise • Risk Management/Oversight • Strategy and M&A Other Current Public Company Directorships: • None Former Public Company Directorships Held during the Past 5 Years: • None Mr. Jackson has served as Vice President, Financial Services and Fixed Operations, of Hendrick Automotive Group, the largest privately held automotive retail organization in the United States, since March 2020 and previously served as Vice President, Financial Services, from April 2018 to March 2020, and as Director of Business Development and Strategic Initiatives from August 2015 until April 2018. Prior to joining Hendrick Automotive Group, Mr. Jackson held positions with PricewaterhouseCoopers as Director -- Advisory from 2012 until 2015 and Chrysler Financial as Chief Operating Officer in 2008. Mr. Jackson also serves as a Board Member on the North Carolina Automobile Dealers Association. |

Age 53 Director Committees: • None | MICHAEL T. SPEETZEN | |

Skills and Qualifications: • Accounting and Financial Expertise • Consumer/Manufacturing Industry Expertise • Corporate Governance Experience • Executive Leadership Experience • Global Experience • Innovation/Technology • Risk Management/Oversight • Strategy and M&A Other Current Public Company Directorships: • Pentair plc Former Public Company Directorships Held during the Past 5 Years: • None Mr. Speetzen was appointed Chief Executive Officer on April 30, 2021; preceding this, he was Interim Chief Executive Officer since January 1, 2021. Mr. Speetzen joined Polaris in August 2015 as Executive Vice President and Chief Financial Officer. Prior to joining Polaris, Mr. Speetzen was Senior Vice President and Chief Financial Officer of Xylem, Inc., a leading water technology company, since 2011, when the company was formed from the spinoff of the water businesses of ITT Corporation, a worldwide manufacturing company. He joined ITT in 2009. Mr. Speetzen was responsible for the financial planning, accounting, controls, treasury, M&A activity, investor relations and strategy of Xylem Inc. Prior to joining ITT, Mr. Speetzen served as Executive Vice President and Chief Financial Officer for the StandardAero Company, a maintenance, repair and overhaul service provider, owned by the private equity firm Dubai Aerospace Enterprise. Previously, he held positions of increasing responsibility in the finance functions of Honeywell and General Electric. |

| 2023 Proxy Statement - |  | 28 |

Age 61 INDEPENDENT Committees: • Compensation • Corporate Governance and Nominating, Chair | JOHN P. WIEHOFF | |